The Millionaire Fastlane: A Contrarian Roadmap to Rapid Wealth

M.J. DeMarco's "The Millionaire Fastlane" fundamentally challenges everything you've been taught about building wealth. This isn't another recycled "get rich slow" manifesto preaching frugal living and 401(k) contributions. Instead, DeMarco presents a mathematical and systematic approach to creating substantial wealth through entrepreneurship—potentially in 5-10 years rather than 40-50. His central thesis: traditional financial advice is fundamentally flawed because it trades your best years for money you'll receive when you're too old to enjoy it.

What makes this book particularly compelling is DeMarco's credibility. He's not a guru selling courses about wealth—he's an entrepreneur who built and sold a limousine booking website for $8 million, retiring at 33. His approach combines harsh mathematical realities with actionable frameworks, making it both a wake-up call and a practical guide for aspiring entrepreneurs. The book's revolutionary insight lies in its "Three Roadmaps" framework, which categorizes every financial approach into distinct paths with predictable outcomes. For entrepreneurs and startup founders, this book offers a systematic methodology for evaluating business opportunities and building scalable wealth-generating systems.

Author background and credentials

M.J. DeMarco brings substantial real-world experience to his wealth-building philosophy. After graduating college with a finance degree, he struggled through multiple business failures before teaching himself web development and marketing. Working as a limo driver while building his website, he eventually created Limos.com, a global ground transportation aggregator that he sold for $1.2 million in 2001. After reacquiring the company through bankruptcy reorganization, he streamlined operations and sold it again in 2007 for $8 million to a Phoenix-based private equity firm.

DeMarco's current ventures include Viperion Publishing Corp, GoalSumo.com, and The Fastlane Forum—an entrepreneurial community with over 80,000 members and 1 million posts. He lives in Alpine, Utah, in a 13,000 square foot home, having achieved his goal of creating wealth while young enough to enjoy it. This background gives him unique credibility—he's not teaching theoretical concepts but sharing the exact methodology he used to build substantial wealth.

Complete chapter-by-chapter breakdown

Part I: Wealth in a Wheelchair (Chapters 1-9)

DeMarco opens with a devastating critique of traditional financial advice, arguing that "get rich slow" actually means "get rich old." Chapter 1: The Great Deception exposes how financial advisors promote time-based wealth strategies that rob you of your prime years. Chapter 2: How I Screwed "Get Rich Slow" shares his personal transformation after a 90-second encounter with a young Lamborghini owner who shattered his assumptions about wealth creation.

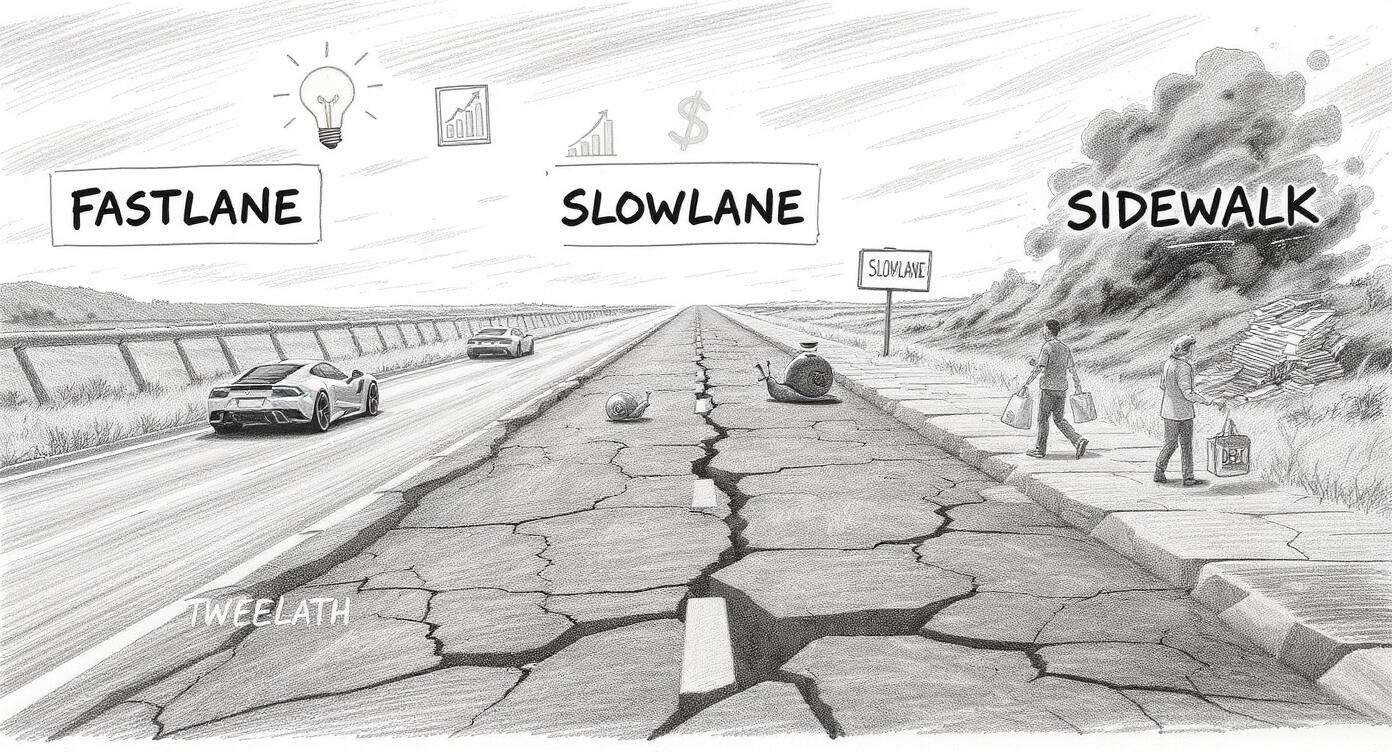

Chapter 3: The Road Trip to Wealth introduces the book's central metaphor, presenting wealth as a journey requiring four components: your roadmap (beliefs), your vehicle (you), your roads (opportunities), and your speed (execution). Chapter 4: The Roadmaps to Wealth establishes the three distinct financial paths that govern all wealth-building approaches.

Chapters 5-7 dissect the "Sidewalk" roadmap, where people prioritize immediate gratification and live paycheck to paycheck. DeMarco introduces the "Wealth Trinity"—Family, Fitness, and Freedom—as the true definition of wealth, contrasting it with toxic cultural definitions focused on luxury possessions. Chapter 7: Lifestyle Servitude reveals how material purchases create bondage rather than freedom.

Chapters 8-9 address personal responsibility and accountability, arguing that wealth demands taking control of your financial destiny rather than hoping for luck or depending on others.

Part II: The Slowlane Deception (Chapters 10-15)

Chapter 10: The Lie You've Been Sold begins the systematic dismantling of traditional retirement planning. DeMarco argues that the Slowlane represents a "five-for-two trade"—giving up five days of your life for two days of freedom each week. Chapter 11: The Criminal Trade presents six major problems with jobs: trading time for money, limited learning, no financial control, office politics, "pay yourself last" taxation, and arbitrary income limitations.

Chapter 12: The Slowlane: Why You Aren't Rich introduces the mathematical foundation of his argument. The Slowlane operates on "Uncontrollable Limited Leverage," where wealth depends on job income and market investments—variables largely outside your control. Chapter 13: The Futile Fight examines how education often creates debt servitude rather than wealth.

Chapter 14: The Hypocrisy of the Gurus exposes the "Paradox of Practice"—how financial gurus get rich selling Slowlane advice while building Fastlane businesses. Chapter 15: Slowlane Victory outlines seven dangers of traditional retirement planning, including health risks, job insecurity, and lifestyle restrictions.

Part III: The Fastlane Revelation (Chapters 16-21)

Chapter 16: Wealth's Shortcut introduces the Fastlane concept, emphasizing "Controllable Unlimited Leverage" where you control the variables that determine your wealth. Chapter 17: Switch Teams advocates shifting from consumer to producer mindset, joining "Team Producer" by creating value rather than just consuming it.

Chapter 18: How the Rich Really Get Rich presents the Fastlane Wealth Equation: Wealth = Net Profit + Asset Value, where Asset Value = Net Profit × Industry Multiplier. This formula shows how businesses create wealth through both cash flow and asset appreciation. Chapter 19: Divorce Wealth from Time introduces five business "seedlings" that can become "money trees"—income-generating systems that operate independently of your time.

Chapter 20: Recruit Your Army of Freedom Fighters explains how saved money becomes "freedom fighters" working for you, while Chapter 21: The Real Law of Wealth presents the "Law of Effection"—the more lives you affect in scale or magnitude, the richer you become.

Part IV: Your Vehicle (Chapters 22-28)

This section focuses on personal development and preparation. Chapter 22: Own Yourself First emphasizes proper business structure for tax advantages and liability protection. Chapter 23: Life's Steering Wheel introduces decision-making frameworks including Worst Case Consequence Analysis and Weighted Average Decision Matrix.

Chapters 24-25 address perception management and environmental factors, advocating for positive influences and eliminating "headwind bloviators." Chapter 26: Your Primordial Fuel distinguishes between "free time" and "indentured time," showing how debt creates time slavery.

Chapter 27: Change That Dirty Oil promotes continuous learning and practical education, while Chapter 28: Hit the Redline differentiates between commitment and interest, emphasizing total dedication to success.

Part V: The Roads to Wealth (Chapters 29-36)

Chapter 29: The Right Road Routes introduces the Five Fastlane Commandments (CENTS framework). Chapters 30-34 detail each commandment:

- Control: Maintain control over all business aspects

- Entry: Higher barriers create stronger opportunities

- Need: Solve real market problems, not personal desires

- Time: Detach income from personal time investment

- Scale: Build businesses capable of affecting millions

Chapter 35: Rapid Wealth presents the "Three I's"—Internet, Innovation, and Intentional Iteration—as the fastest Fastlane routes. Chapter 36: Find Your Open Road teaches opportunity recognition through complaints and inefficiencies.

Part VI: Your Speed (Chapters 37-45)

The final section covers execution and implementation. Chapter 37: Give Your Road a Destination provides a four-step process for defining financial goals and calculating your "escape number." Chapter 38: The Speed of Success emphasizes that execution separates winners from losers.

Chapter 39: Burn the Business Plan argues for immediate action over planning, while Chapter 40: Pedestrians Will Make You Rich focuses on superior customer service strategies. Chapters 41-43 cover partner selection, market differentiation, and brand building.

Chapter 44: Choose Monogamy Over Polygamy advocates focusing on one business at a time, while Chapter 45: Put It Together provides a 19-step implementation guide called the "FASTLANE SUPERcharger."

The three wealth roadmaps: A mathematical breakdown

DeMarco's most powerful insight lies in his mathematical analysis of the three financial approaches:

The Sidewalk Roadmap: Destination Poorness

Wealth Equation: Wealth = Income + Debt Sidewalkers prioritize immediate gratification and live paycheck to paycheck. They use credit to buy things now, disregard time's value, and view money as a tool for showing off. This path leads inevitably to poverty because it creates no assets while accumulating liabilities.

The Slowlane Roadmap: Destination Mediocrity

Wealth Equation: Wealth = (Job Income) + (Market Investments) The Slowlane represents traditional financial advice: work hard, save 10% of income, invest in 401(k)s and mutual funds, hope for compound interest over 40+ years. DeMarco demonstrates mathematically why this approach fails:

- Time Dependency: Requires 40-50 years to accumulate wealth

- Uncontrollable Variables: Success depends on job market, stock market, and economic conditions

- Compound Interest Limitations: Only powerful with large initial sums (7% of $10,000 = $700 vs. 7% of $5,000,000 = $350,000)

- Age Problem: By the time you're wealthy, you're too old to enjoy it

The Fastlane Roadmap: Destination Wealth

Wealth Equation: Wealth = Net Profit + Asset Value Expanded Formula: Asset Value = Net Profit × Industry Multiplier

The Fastlane operates on "Controllable Unlimited Leverage" where you control the variables determining your wealth. Net Profit = Units Sold × Unit Profit, meaning you can increase wealth by selling more units, increasing profit per unit, or both. Asset Value multiplies this impact through industry valuation multiples (technology companies might trade at 10x revenue, while service businesses might trade at 3x revenue).

The CENTS framework: Five commandments for fastlane businesses

DeMarco's CENTS framework provides systematic criteria for evaluating business opportunities:

Control: You must maintain control over every aspect of your business system. When you relinquish control to a higher authority (employer, franchisor, platform), you accept "good money" as a passenger instead of "big money" as the driver. This explains why jobs and franchises rarely create substantial wealth.

Entry: As entry barriers to any business fall, effectiveness declines while competition increases. Higher entry barriers equate to stronger, more profitable opportunities with less competition. Avoid businesses where "everyone is doing it."

Need: Businesses must solve real market needs and provide genuine value. DeMarco warns against the "doing what you love" trap if it doesn't address market problems. Money flows to businesses that solve problems, not pursue passions.

Time: Your business and its income must detach from your personal time investment. The goal is creating systems that generate revenue without constant involvement, enabling true passive income and scalability.

Scale: The business must have potential to expand from local to worldwide, affecting millions of people. Scale creates the leverage necessary for substantial wealth creation through the Law of Effection.

The law of effection: The mathematics of impact

DeMarco's "Law of Effection" replaces popular "Law of Attraction" concepts with actionable business principles: "The more lives you affect in an entity you control, in scale and/or magnitude, the richer you will become."

Mathematical Expression: Net Profit = Units Sold (Scale) × Unit Profit (Magnitude)

- Scale: Affecting millions with small impact (selling 20 million pens at 75 cents profit = $15 million)

- Magnitude: Affecting fewer people with high impact (luxury goods, specialized services)

- Scale + Magnitude: Creates billionaires by combining both approaches

This principle explains why McDonald's creates more wealth than a high-end restaurant despite lower profit margins—McDonald's affects millions of people globally while the restaurant affects hundreds locally.

Key wealth-building principles and strategies

Producer vs. Consumer Mindset Shift

Traditional approach (Consumer): Buy products, take classes, borrow money, take jobs Fastlane approach (Producer): Sell products, offer classes, lend money, hire employees

This fundamental shift determines whether you're creating wealth or consuming it. Producers build assets that appreciate, while consumers buy liabilities that depreciate.

Business System Types: The Five Seedlings

DeMarco identifies five business models that can become "money trees":

- Rental Systems (Grade A): Real estate, equipment rental, licensing intellectual property

- Computer/Software Systems (Grade A-): Internet businesses, SaaS platforms, mobile apps

- Content Systems (Grade B+): Books, blogs, information products, media networks

- Distribution Systems (Grade B): Platforms connecting producers with consumers

- Human Resource Systems (Grade C): Businesses requiring people to operate

The Three I's: Fastest Fastlane Routes

- Internet: Provides global reach, scalable systems, and automation capabilities

- Innovation: Creating new solutions or improving existing ones

- Intentional Iteration: Systematically improving existing solutions through feedback loops

Time Philosophy and Leverage

DeMarco distinguishes between "indentured time" (total time spent earning money) and "free time" (available for personal pursuits). "Parasitic debt" represents the leading cause of indentured time by forcing continued work to service obligations.

The Fastlane goal involves creating systems that buy back time through passive income, enabling choice and freedom rather than obligation and servitude.

Practical takeaways for entrepreneurs and startup founders

Business Evaluation Framework

Use the CENTS framework to evaluate every business opportunity:

- Can you control all aspects of the business?

- Are there sufficient entry barriers to protect your position?

- Does it solve real market needs?

- Can it operate without your constant involvement?

- Does it have potential for massive scale?

Customer Service Strategy: SUCS

Superior Unexpected Customer Service exceeds expectations to create "raving fans" who become unpaid evangelists for your business. This approach transforms customers into marketing assets.

Complaint Analysis for Opportunities

Four types of complaints provide business intelligence:

- Complaints of Change: Resistance to business modifications

- Complaints of Expectation: When service doesn't meet standards

- Complaints of Void: Requests for unavailable products/services (gold mine opportunities)

- Complaints of Fraud: Deceptive practices in the industry

Decision-Making Frameworks

WCCA (Worst Case Consequence Analysis): For major decisions, ask:

- What's the worst-case consequence?

- What's the probability of this outcome?

- Is this an acceptable risk?

WADM (Weighted Average Decision Matrix): Quantitative approach assigning values to different factors and outcomes.

Marketing and Differentiation

- WIIFM (What's In It For Me): Focus on benefits, not features

- Unique Selling Proposition: Differentiate through specific, measurable advantages

- Emotional Marketing: Most buying decisions are driven by emotions rather than logic

Implementation Strategy

- Focus on execution over planning

- Use market feedback to iterate and improve

- Build prototypes and operating businesses rather than theoretical models

- Embrace failure as learning opportunities that accelerate success

Strengths and weaknesses: A balanced assessment

Strengths

Mathematical Foundation: DeMarco uses clear mathematical examples demonstrating traditional wealth-building limitations. His wealth equations provide concrete frameworks for understanding different approaches rather than vague motivational concepts.

Practical Framework: The CENTS framework offers systematic criteria for evaluating business opportunities, providing actionable guidance rather than general inspiration.

Credibility: As a successful entrepreneur who built and sold businesses, DeMarco provides real-world experience rather than theoretical knowledge.

Motivational Impact: Successfully challenges conventional wisdom and inspires readers to think differently about wealth creation and career choices.

Honest Approach: Acknowledges that entrepreneurship requires significant effort and involves substantial risks, avoiding "get rich quick" promises.

Weaknesses

Oversimplification: Some critics argue the book oversimplifies complex business and economic concepts, potentially leading to poor decision-making without additional business education.

Limited Risk Management: Insufficient guidance on identifying and mitigating entrepreneurial risks, particularly for readers without business experience.

Polarizing Tone: DeMarco's assertive, sometimes brash writing style may alienate readers who prefer balanced approaches to financial planning.

Implementation Gap: Strong on motivation but weaker on specific execution strategies and detailed business-building guidance.

Survivor Bias: Focuses heavily on success stories without adequate discussion of failure rates and challenges in entrepreneurship.

Dismissive Attitude: Completely dismisses traditional financial approaches that may be appropriate for certain individuals or circumstances.

Comparisons to other entrepreneurship and wealth-building books

Versus "Rich Dad Poor Dad" by Robert Kiyosaki

Both books challenge conventional financial wisdom and promote asset-building over saving. However, DeMarco provides more specific business execution frameworks compared to Kiyosaki's broader conceptual approach. DeMarco is also more critical of traditional investing, while Kiyosaki emphasizes real estate investment. The mathematical approach in "Fastlane" offers more concrete guidance than "Rich Dad's" philosophical concepts.

Versus "Think and Grow Rich" by Napoleon Hill

Both emphasize mindset transformation and the power of focused thinking. However, DeMarco provides concrete business principles and systematic frameworks rather than Hill's philosophical and visualization-based approach. "Fastlane" focuses more on practical execution while "Think and Grow Rich" emphasizes mental conditioning and success principles.

Versus "The Lean Startup" by Eric Ries

Both advocate entrepreneurship and rapid iteration based on market feedback. DeMarco focuses more on wealth creation and scale, while Ries emphasizes product development and customer discovery. They share similar beliefs about solving real customer problems and avoiding theoretical planning in favor of market-driven execution.

Versus "The 4-Hour Workweek" by Tim Ferriss

Both promote lifestyle design and passive income creation. However, DeMarco is more critical of "lifestyle businesses" that don't scale substantially, emphasizing wealth creation over lifestyle optimization. Ferriss focuses on efficiency and automation for lifestyle purposes, while DeMarco emphasizes building substantial wealth through scalable business systems.

Versus "The E-Myth Revisited" by Michael Gerber

Both emphasize the importance of building systems-dependent businesses rather than owner-dependent operations. Gerber focuses on franchising and systematization, while DeMarco emphasizes scale and the CENTS framework. They share similar beliefs about creating businesses that can operate without constant owner involvement.

Target audience and ideal readers

Primary Audience

Aspiring Entrepreneurs: Individuals seeking alternatives to traditional career paths who want systematic frameworks for building wealth through business creation.

Young Professionals: Recent graduates or early-career individuals disillusioned with corporate employment who seek financial independence before traditional retirement age.

Existing Business Owners: Entrepreneurs looking to scale beyond trading time for money and build systems that generate passive income.

FIRE Movement Participants: People interested in Financial Independence, Retire Early through entrepreneurship rather than traditional investing.

Secondary Audience

Students: Individuals considering career paths who want to understand alternative approaches to financial success.

Traditional Finance Readers: People familiar with conventional financial advice who want contrarian perspectives and mathematical analysis of different approaches.

Career Changers: Individuals considering transitions from traditional employment to entrepreneurship.

Not Ideal For

Risk-Averse Individuals: Those comfortable with traditional employment and conventional financial planning who prefer stability over potential high returns.

Passive Investment Seekers: People looking for set-and-forget investment strategies rather than active business building.

Get-Rich-Quick Seekers: Individuals expecting magical formulas or overnight success rather than systematic business development.

Those Without Action Orientation: Readers seeking entertainment or motivation without commitment to implementation.

Notable quotes and transformative insights

Core Philosophy

"There's a profound difference between interest and commitment. Interest reads a book; commitment applies the book 50 times." This quote encapsulates DeMarco's emphasis on execution over consumption.

"Instead of digging for gold, sell shovels." Classic business wisdom emphasizing serving needs rather than chasing trends.

"Make a freaking impact and start providing value! Let money come to you!" Represents the book's focus on value creation as the foundation of wealth.

Time and Wealth Philosophy

"Time isn't a commodity, something you pass around like a cake. Time is the substance of life." This insight reframes how entrepreneurs should value their most precious resource.

"Wealth is best lived in the prime of your life, not in its twilight after 40 years of 50-hour workweeks have pulverized your dreams into surrender." Challenges the fundamental assumption of traditional retirement planning.

"If you have to think about 'affordability,' you can't afford it because affordability carries conditions and consequences." Redefines what it means to be truly wealthy.

Provocative Statements

"The global recession has exposed the Slowlane for the fraud it is. With no job, the plan fails. When the stock market loses 50% of your savings, the plan fails." Challenges the security of traditional approaches.

"People who declare, 'Money doesn't buy happiness' have already concluded they will never have money." Addresses common limiting beliefs about wealth.

Action and Execution

"Your choices are made in a moment, and yet their consequences transcend a lifetime." Emphasizes the long-term impact of daily decisions.

"The owner of an idea is not he who imagines it, but he who executes it." Reinforces the book's emphasis on implementation over ideation.

Real-world applications for startup founders

Business Model Selection

Use the CENTS framework to evaluate potential business models:

- SaaS Platforms: High control, medium entry barriers, solve real needs, scalable, time-detached

- E-commerce: Medium control (depending on platform), low entry barriers, variable need satisfaction, highly scalable

- Consulting: High control, low entry barriers, high need satisfaction, limited scalability, time-attached

- Franchising: Low control, high entry barriers, proven need satisfaction, scalable, time-detached

Customer Development Strategy

Apply the Law of Effection to product development:

- Identify problems affecting millions of people (scale)

- Develop solutions with significant impact (magnitude)

- Focus on markets with substantial pain points

- Build systems that can serve large customer bases

Revenue Model Design

Structure business models for Fastlane compliance:

- Subscription Models: Create recurring revenue streams that grow independently

- Marketplace Platforms: Build systems connecting multiple parties for ongoing transactions

- Licensing: Develop intellectual property that generates passive income

- Automated Systems: Create technology that serves customers without direct involvement

Customer Service Excellence

Implement SUCS (Superior Unexpected Customer Service):

- Exceed expectations consistently

- Transform customers into marketing assets

- Use exceptional service as competitive differentiation

- Build systems that scale excellent service

Growth Strategy Framework

- Phase 1: Build systems meeting CENTS criteria

- Phase 2: Focus on scale through market expansion

- Phase 3: Optimize for magnitude through increased value per customer

- Phase 4: Combine scale and magnitude for maximum impact

Success stories and real-world impact

Documented Transformations

Multiple readers have documented significant business success following the book's principles:

- Technology Entrepreneurs: Several SaaS companies valued at 8-10x revenue following the asset value formula

- E-commerce Success: Readers building million-dollar online businesses using the scale principles

- Service Business Optimization: Traditional service providers restructuring for better CENTS compliance

- Career Transitions: Numerous stories of people leaving traditional employment to build scalable businesses

Business Community Impact

The book spawned The Fastlane Forum, an entrepreneurial community with over 80,000 members sharing real-world implementations of the book's principles. This community provides ongoing case studies and refinements of the concepts.

Measurable Outcomes

While specific statistics are limited, readers frequently report:

- Income Increases: From minimum wage to six-figure business income within 2-3 years

- Asset Building: Creating businesses valued at multiple times annual revenue

- Time Freedom: Achieving location and schedule independence through systematic business building

- Wealth Acceleration: Building substantial wealth in 5-10 years rather than traditional 40-year timelines

Conclusion and final recommendations

"The Millionaire Fastlane" succeeds as both a paradigm-shifting manifesto and a practical guide for entrepreneurs seeking rapid wealth creation. Its greatest strength lies in providing mathematical frameworks that expose the limitations of traditional financial advice while offering systematic alternatives through the CENTS framework and Law of Effection.

The book's revolutionary insight involves recognizing that wealth is a process, not an event—but it's a process that can be systematized, controlled, and accelerated through proper business building rather than passive hoping. For entrepreneurs, it provides essential frameworks for evaluating opportunities and building scalable systems that generate both cash flow and asset value.

Best suited for: Individuals genuinely committed to entrepreneurship who can apply the frameworks systematically while maintaining appropriate risk management. The book works best as a mindset shifter and framework provider rather than a complete business manual.

Should be approached with caution by: Those without sufficient business experience or financial literacy who might interpret the advice as encouraging reckless risk-taking. The book's dismissive attitude toward traditional approaches may not suit individuals in certain circumstances.

Maximum value occurs when: Combined with other business education resources, proper financial planning, and gradual implementation of the principles. The book serves as an excellent catalyst for entrepreneurial thinking but should be supplemented with industry-specific knowledge and risk management strategies.

For startup founders and aspiring entrepreneurs, "The Millionaire Fastlane" offers a compelling alternative to traditional wealth-building approaches, providing both the motivation to think differently and the frameworks to act systematically. Its lasting impact lies in shifting readers from consumer to producer mindset while providing concrete criteria for building wealth-generating business systems.

The book's ultimate message resonates with ambitious entrepreneurs: true wealth comes from affecting lives at scale through controllable business systems, not from hoping that traditional approaches will eventually provide financial freedom. For those willing to embrace the challenges and opportunities of entrepreneurship, it offers both the philosophical foundation and practical frameworks necessary for building substantial wealth while young enough to enjoy it.